Unveiling Amazon’s APAC Seller Strategies: 1P vs 3P

Read about the differences between 1P and 3P seller strategies and learn about the evolving ecommerce landscape of Amazon in APAC.

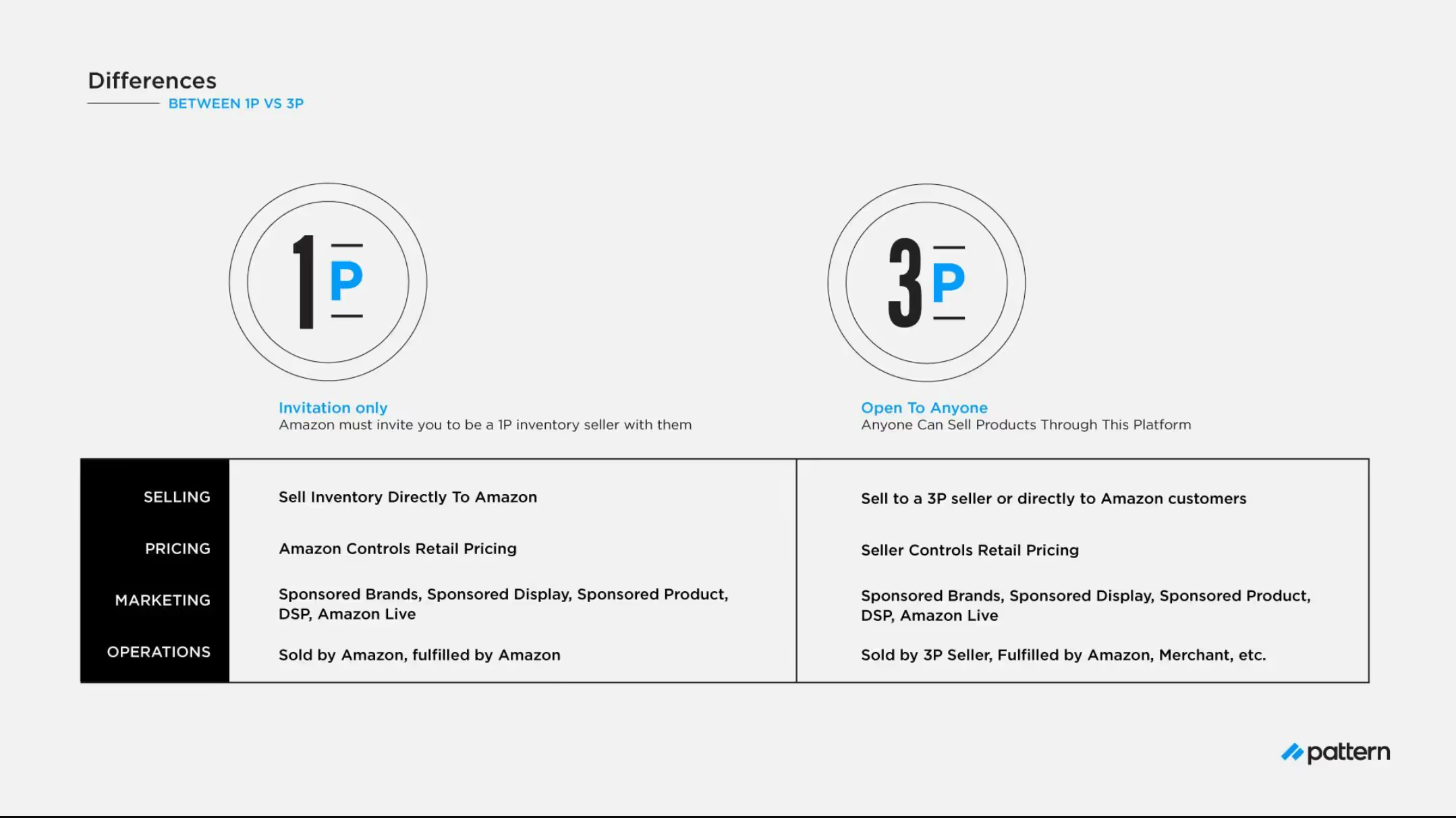

As Amazon continues its impressive expansion into the dynamic markets of the Asia-Pacific region (APAC), brands seeking to venture into this rapidly growing terrain are faced with a crucial decision—sell through a 1P (First-Party) model or a 3P (Third-Party/trade-partner) seller model?

With a firm foothold in countries like Japan, Singapore, and Australia, Amazon has become a formidable force in APAC, presenting an unparalleled opportunity for international brands looking to tap into this burgeoning consumer base. For your best chance of success, it's critical to understand the differences between 1P and 3P seller strategies and learn about the evolving ecommerce landscape of Amazon in APAC.

1P vs 3P Seller Strategies

For brands considering expanding to Amazon in APAC, they may be wondering if they should have a 1P or 3P strategy. Read about the pros and cons of 1P vs 3P.

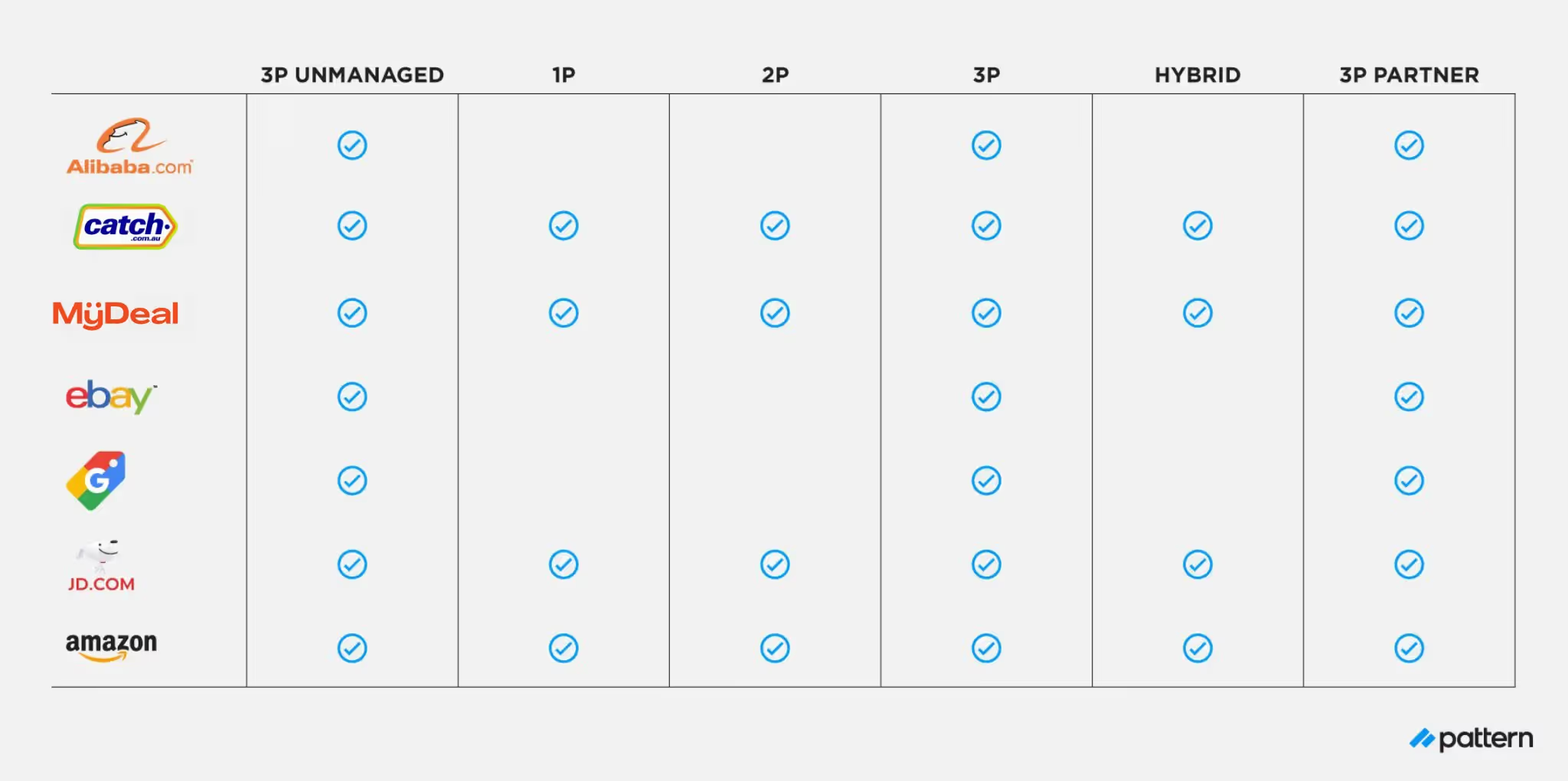

The difference between Amazon 1P vs 3P sellers in the APAC region is similar to what it is for the United States. Amazon in the APAC region has other seller strategies such as 3P unmanaged, 1P, 2P, 3P, Hybrid, or a 3P Partner. Other marketplaces throughout the APAC region have various seller strategies similar to Amazon:

The good news for 3P sellers on Amazon is that 3P has been growing twice as fast as 1P sellers. If you're considering the switch, now is a great time to do so.

Common 1P Seller Pain Points

In our experience, Amazon 1P struggles are pretty universal:

- Limited 1P vendor management support

- Amazon VMS supports categories, not brands

- Pricing issues

- Global expansion roadblocks

- Operations difficulties

- Chargebacks/shortage claims

- Tickets/daily workload

- Cost increases

- Lack of data

- Annual Vendor Negotiations (AVN)

For brands dealing with the above pain points, switching to become a 3P seller on Amazon may be the best option to get their brand under control and start growing their business.

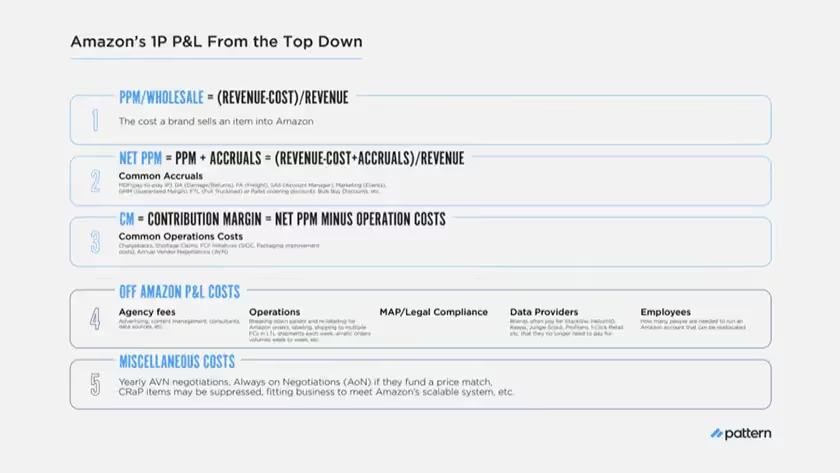

True Cost of a 1P Seller Relationship With Amazon

Most brands struggle to identify the true costs of having a first party (or 1P) seller relationship with Amazon. The costs of a 1P relationship are not always straightforward and apparent. Here’s a cheat sheet of what brands should consider to calculate the true costs of being an Amazon 1P seller. A member of the Pattern team can also help you understand the true cost and realize opportunities for savings.

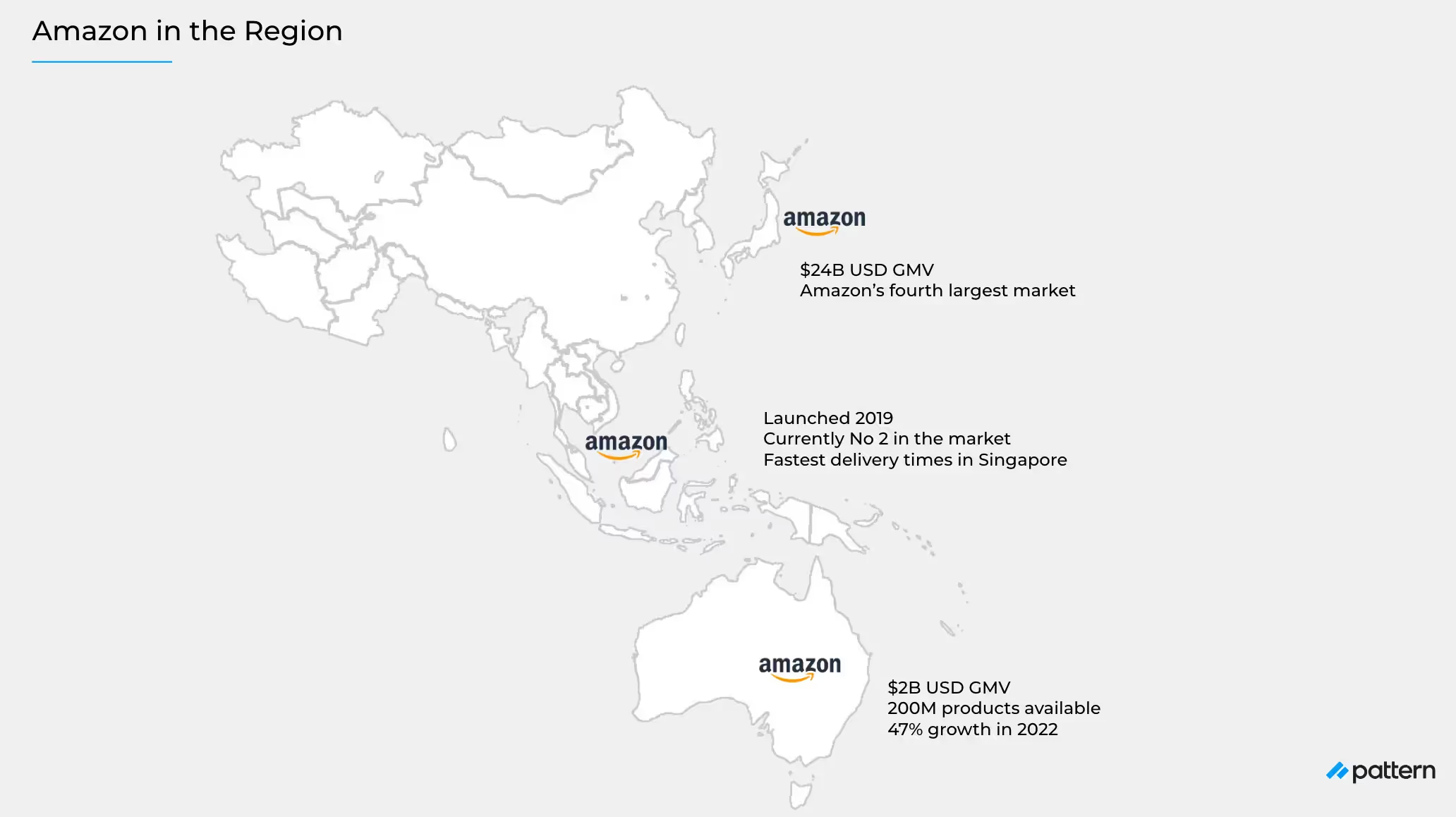

Amazon Opportunities in APAC Region

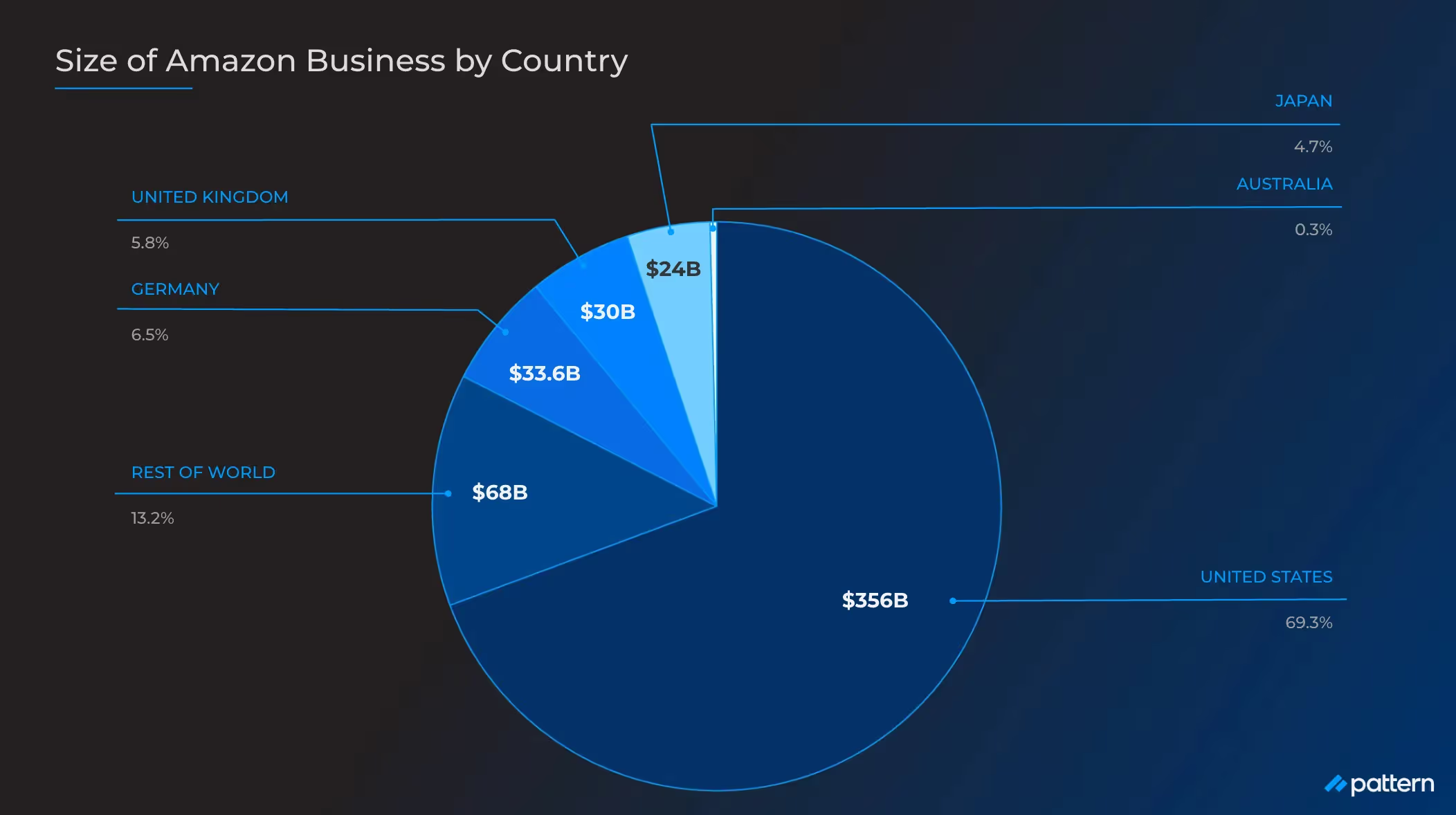

The APAC region gives brands many potential opportunities on Amazon as either a 1P or 3P seller. With its rapidly-increasing consumer base and growing ecommerce ecosystem in multiple countries, selling in APAC can be a highly profitable move for product brands. Two of Amazon’s top four counties (in terms of size of Amazon business) are in the APAC region:

- United Kingdom

- Germany

- Japan

- Australia

If we look at Amazon within the APAC region, there are multiple opportunities for brands to expand and launch their business in established and growing markets.

Even at a quick glance, it's clear that APAC markets offer a valuable opportunity to brands:

- Amazon Japan

- $24B USD GMV

- Amazon’s fourth largest market

- Amazon Australia

- $2B USD GMV

- 200M products available

- 47% Growth in 2022 (started in Australia 4 years ago and is now the #1 marketplace in Australia)

- Amazon Singapore

- Launched in 2019

- Currently #2 marketplace in the market

- Fastest delivery times in Singapore

Expand to APAC Amazon with Pattern

Pattern, a global ecommerce accelerator, is the #1 Amazon seller globally with experience, expertise, data, and technology to help brands solve the pain points they face selling on Amazon. As a 3P seller, Pattern acts as a trusted partner to hundreds of brands, investing in their business’ success on Tmall, JD, Pinduoduo, Douyin, Amazon, Rakuten, Coupang, Lazada, and Shopee. Pattern also provides partners with access to offline and B2B distribution networks, and proprietary private channels in China.

Contact us if you’re interested in selling on Amazon in the APAC region.

.jpg)

.jpg)

.jpg)