Consumer Brands Not Yet Optimising their Amazon.ae Presence

Pattern has released research ranking the customer experience provided by 50 brands based on their Amazon.ae presence to highlight areas of improvement.

50 consumer brands selling on Amazon.ae reviewed, average score of only 40% against a list of best practice criteria with beauty brand CeraVe the top performer

UNITED ARAB EMIRATES - 6th May 2021

Global marketplace seller Pattern has analysed 50 consumer brands selling on Amazon.ae to understand and create a benchmark for best practice on the platform. The analysis of their Amazon.ae presence has been published in our Amazon UAE Benchmarking Report available for free download and will be discussed in a webinar taking place on 25th May that you can sign up for now.

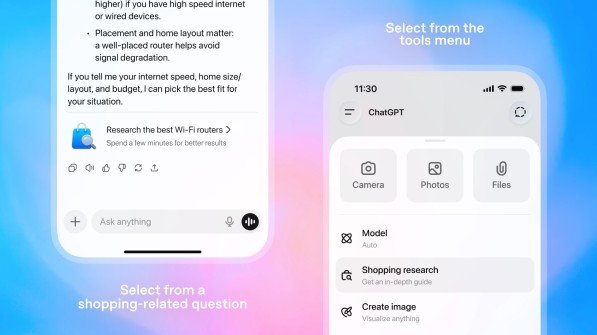

The report highlights how well brands in five key product categories – Beauty, Electronics, Fashion & Accessories, Home & Kitchen and Vitamins & Supplements - are managing the customer experience they deliver on Amazon.ae to maximise sales of their products. The brands were assessed against a set of criteria that measures how well their top three listings performed, including: product information & imagery, branded content, seller competition, customer service, ratings & reviews, Amazon search engine optimization, and localization.

The top performing brand overall was CeraVe, with a score of 60%, while the brand with the lowest score achieved just 20%. Home & Kitchen was the top performing category (46%), closely followed by Electronics (45%). The top 10 scoring brands in the Amazon UAE Benchmarking were: CeraVe (60%), Nutricook (58%), Under Armour (57%), Samsung (56%), Philips Hue and De’Longhi (53%), Fitbit and Puma (52%), Logitech (50%) and Waterpik (49%).

Pattern reviewed the top three product listings found when searching for the brand on Amazon.ae. We would expect these top listings be a focus for optimisation, as they are likely to be the best-selling items. In many cases, it was found that best practice was being adhered to on some, but not all, of a brand’s listing. The majority of brands had vast areas of improvements across all the criteria analysed.

Highlights from the report:

- Most of the brands performed poorly on having Amazon SEO-friendly product titles; only 6% of brands achieving this on all of their top three listings.

- Brands were not consistently maximizing the use of branded content - 20% linked to a branded storefront and 30% included A+ content on all listings.

- Product imagery was another aspect where brands could improve their listings to encourage more customers to buy. 88% were consistently using high-quality images, but only 32% used close-up imagery, 18% used simple text on secondary images, and only 4% included video content.

- 49 of the 50 brands failed to respond to customer questions on their listings - leaving other consumers or third-party sellers to answer.

- While many Amazon.ae listings include product ratings & reviews from other markets, we know that reviews from customers in the UAE are particularly valued by other potential buyers. Brands in the Home & Kitchen category scored worst on this measure, with 37% of listings having no local reviews. Electronics scored best, with only 7% of listings having no local reviews.

- Amazon Advertising is still a relatively new concept for the UAE market so there was little competition on Sponsored Products or on Sponsored Brand ads; 86% and 94% respectively, were not yet using these ad types.

Pattern’s MENA MD, David Quaife, said of the findings, “Last year COVID accelerated the adoption of ecommerce and particularly online marketplaces such as Amazon in the UAE. It is more important than ever for brands to ensure that they are well represented on these highly visible marketplaces, which have the major share of online traffic.”

“Brands selling in the UAE need more cohesion across their marketplace listings, as well as fully leveraging the features Amazon provides to ensure browsers convert to buyers. The speed at which businesses can acquire the skillset to optimise their Amazon presence, or work with a partner such as Pattern, will determine their sales growth on the platform this year.”

You can download the full report here.

About Pattern Inc

Pattern is the premier ecommerce partner to global brands helping them to deliver profitable growth through their ecommerce sites and online marketplaces such as Amazon, Noon, eBay and Tmall. With employees in 18 locations globally – including the United Arab Emirates – we are one of the world’s largest Amazon sellers. We act as the authorized Amazon seller to more than 70 brands, buying their stock to sell on the marketplace and taking care of every aspect of their Amazon presence. In addition, our strategy team support the development of brands’ marketplace strategies. For more information, visit www.pattern.com/mena

Media Contacts

Joanna Perry Global Head of Marketing joanna@pattern.com

.jpg)

.jpg)