Analysis: How Coronavirus Is Affecting Ecommerce in China & the U.S.

The coronavirus outbreak is affecting global ecommerce. Pattern analyzed our China and U.S. operations to better understand COVID-19's implications.

The coronavirus outbreak is changing the ecommerce landscape across the globe, for better or for worse. We conducted an analysis at Pattern using data from our China and United States operations to better understand how COVID-19 is affecting ecommerce.

It’s clear from the data that ecommerce in China and the United States have had opposite reactions to COVID-19.

China Sales Decrease, U.S. Sales Increase

Across our sample of 15 Tmall categories (Tmall has 60% of China’s ecommerce marketplace), there was a median 29% sales decrease compared to the same time last year.

In the United States, where quarantines and travel restrictions have been less severe, many ecommerce brands have seen 15-20% increase in sales as people avoid public places, work from home, and prepare for the ‘coronapocalypse.’

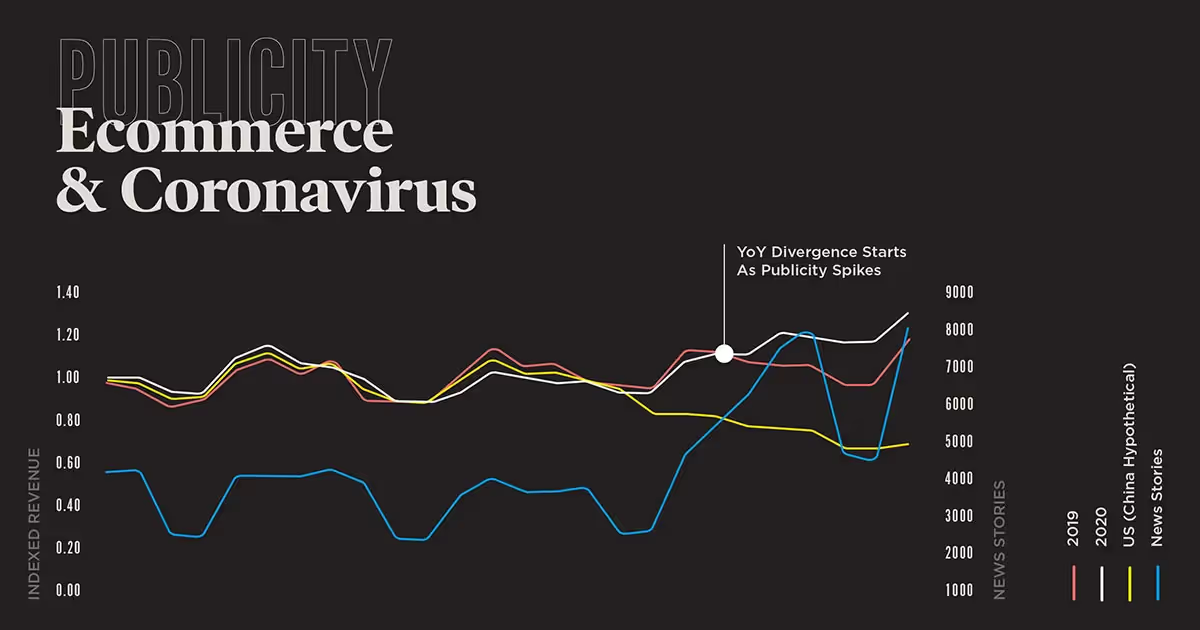

Increased Publicity Spurs Behavior Change

Consumer behavior change, compared to predictions using 2019 trends (usually within 5%), appears to have been spurred by increased publicity of the coronavirus in news articles across the country.

However, the future of ecommerce health in the U.S. depends mainly on how the government will react to further outbreaks of coronavirus. Will they act as China has restricting travel and quarantine cities? Or will they continue to allow deliveries, potentially taking advantage of drone and AV technologies? The two reactions paint a very different picture.

China approach: Quarantine, stop operations

While the United States has not yet faced major lockdowns or regulations, around 48 cities and 750 million people in China have been subjected to travel bans, curfews, and exhaustive surveillance (China has even rolled out facial recognition drones with loud speakers to track and enforce regulations). Many businesses, such as Apple supplier Foxconn, shut down operations, adding to the 60% decline in year-over-year sales for iPhones.

With people avoiding or being prohibited to visit public places, Pattern China General Manager Arthur Cheung estimates that some retail stores in China have had as much as 98% declines in YoY sales. Overall, the impact appears to be closely related to the severity of Coronavirus restrictions.

What about ecommerce? From a sample of 15 Tmall categories (Tmall represents 60% of China’s ecommerce market share), the median category saw a 29% decrease in sales compared to the same time last year. However, some categories have seen massive spikes in sales. Masks are estimated to be selling at about 582% above last year’s levels. Overall, it looks as if ecommerce has not been hit as hard as traditional retail channels, yet has not escaped massive declines in sales brought on by the combination of regulations and public anxiety.

United States approach: Stockpile on goods, continue operations

The marketplace experience in the United States has differed significantly from that of China. Being early in the contraction of Coronavirus, hardly any U.S. cities have experienced travel restrictions or quarantines. However, consumers have reacted strongly to the increased publicity of Coronavirus.

Taking note of the China experience, consumers have emptied many retail stores of their water, toilet paper, and other “pre-apocalypse” supplies in fear of being quarantined. (Who knew that water and TP cured Coronavirus?) And, as more people work from home and avoid public places, many people turn to ecommerce as their main supplier.

Some Pattern supplement brands have had revenue 15-20% above their predicted sales. The future impact of Coronavirus on ecommerce depends largely on how the government will respond to the spread of the virus. Retail stores will almost certainly be negatively impacted as people avoid public places and travel is restricted.

Ecommerce, on the other hand, could either be boom or bust. If, for example, Amazon is allowed to continue delivering their products, ecommerce will see huge increases in demand. But, if Amazon’s fleets are halted, ecommerce will be in the same boat as retail, waiting on the virus and travel restrictions to pass. On a side note, drones and other automated delivery services are receiving the perfect scenario to prove their importance. We expect higher uptake as a result of the outbreak.

Key takeaway: Supply chain diversity wins the day

In preparation for future virus disruptions, brands are seeing the importance of diversity in supply chain and product holding. We’ve seen that brands that have diverse supply chains are able to transition between manufacturing countries and mitigate their risks from supply chain disruption. And, brands that are diverse in their products—with a mix of luxury and more necessity goods—are handling the disruption better than brands completely dedicated to their specific niche.

To learn more about the changing ecommerce landscape and how you can prepare for it, contact Pattern below.

.jpg)