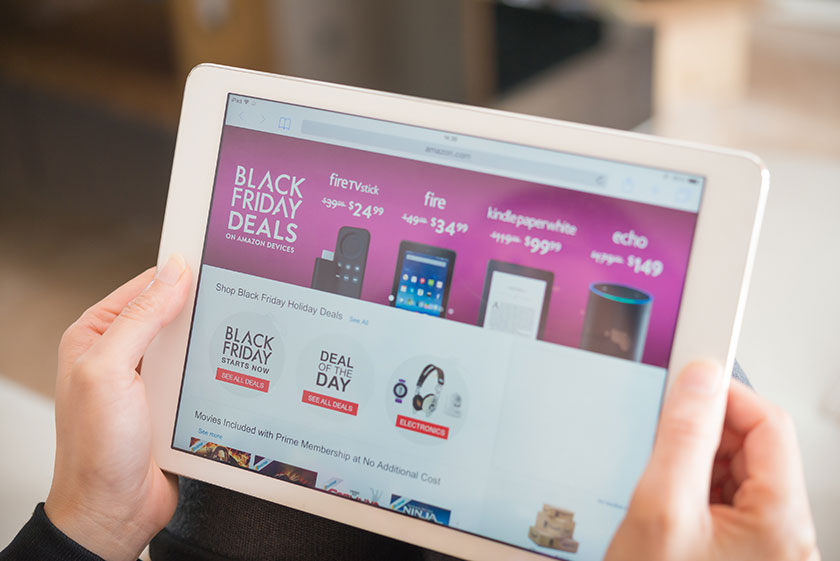

Despite concerns about the economy, Amazon had a record-breaking Black Friday and Cyber Monday last year. Black Friday alone generated $9.12B ecommerce sales on Amazon US. With the online retail giant continuing to dominate the market, and with consumers increasingly comfortable shopping online, the convenience and price wars are expected to drive a large portion of holiday shopping in 2023. If your brand wants a piece of the holiday shopping pie, here are some things you can do now to prepare.

Get Ready to Sell ASAP

Large retailers like Walmart, Best Buy, and Target start advertising their Black Friday and Cyber Monday promotions in October. Although it officially starts on November 24th, the day after Thanksgiving, many deals will be available on Amazon weeks before, with sales getting more aggressive approaching the big day.

November 17th is the day Amazon officially kicks off the Black Friday/Cyber Monday deals, and if your brand wants to throw its hat in the ring, we’d recommend being ready as soon as possible. Even if you weren’t ready for November 17th, it’s important to get your products, listings, and deals ready for as early in November as you can manage.

Build Your Reviews

Shopping online is now more social than ever, and having a strong base of reviews will be essential for a successful Amazon Black Friday/Cyber Monday. Research indicates that 79 percent of shoppers trust online reviews as much as a friend’s recommendation and 89 percent of shoppers read online reviews before buying.

Stock Up on Inventory

It might go without saying, but the best way to prepare for Black Friday and Cyber Monday is to make sure your store has enough inventory to satisfy higher demand. Two of the best ways to do this are to understand how Amazon promotions work, and if you sell using Fulfillment by Amazon, check your inventory to make sure it’s reserved for Black Friday sales.

Lock In Your Advertising Strategy

How will your brand’s audience know about your Amazon Black Friday and Cyber Monday deals? If you haven’t already, strategize on how to spread the word. Will you send out an email campaign, use social media marketing, run PPC campaigns, or advertise directly on Amazon? It is ultimately up to you, but it’s better to have a plan in place than no plan at all.

Consider Free Shipping

Most of Black Friday and Cyber Monday purchases are impulse buys. Usability Sciences performed a study on cart abandoners, and they found that unacceptable shipping options were the second highest reason shoppers abandoned their cart.

Since the window of consideration is so short for most of these holiday shoppers, your brand should consider offering your customers free shipping to sweeten the deal and make clicking the final ‘checkout now’ button as easy as possible.

Bundle Products

If you bundle your products strategically, you’ll increase exposure, sell more, and get the coveted Amazon “Buy Box.” Product bundles on Amazon are convenient and add more value to a customer’s shopping experience. When you create a bundle, Amazon assigns a unique UPC to your offer–essentially creating a new product shoppers can find in the catalog.

Just make sure you follow Amazon’s specific policies on product bundling, and you’ll be set for success.

Keep an Eye on the Competition

With millions of sellers on Amazon worldwide, the competition is pretty steep. Keep track of your competitors’ pricing strategy (and make any needed adjustments) to make sure that your products are competitively priced while still offering a good profit margin for your brand.

Refine SEO

Customers want to find your products and store as easily as possible, and if your SEO isn’t on point, then a competitor will win the Black Friday/Cyber Monday business. Look through your product listings and make sure that your SEO covers all necessary keywords. You don’t want any potential customers slipping through the cracks when the big day arrives. We offer our best tips to optimize your Amazon SEO here.

Account for Promotions in Sales Projections

It sounds obvious, but make sure you account for your brand’s promotions, discounts, and freebies when projecting sales and profit for Amazon Black Friday and Cyber Monday. The last thing you want to do is upset the boss by coming under your projections because you didn’t account for holiday promotions.

With aggressive promotions and traffic flooding into Amazon, the holiday season can contribute to a huge chunk of seller’s revenue. November is going to be a big month for Amazon, and if your brand has prepared adequately for Black Friday and Cyber Monday, it will probably be a great month for you too.

If you’re interested in learning more about how to make the most out of Black Friday or Cyber Monday and how Pattern can help, get in touch today.